JPM 52:25

52 Notable JPM Deals of the Last Decade

+ Discover which companies to watch going into 2025.

Since its inception in 1983, the JP Morgan Biotech Conference has grown to become one of the most significant events in the biotechnology and pharmaceutical industries. Initially a modest gathering aimed at fostering connections and discussions among biotech executives and investors, the conference has evolved over the decades into a highly anticipated global forum. Each January, industry leaders, innovative startups, and visionary investors converge in San Francisco to discuss the latest advancements, trends, and deals shaping the future of biotechnology.

The conference's influence is undeniable, with countless partnerships and groundbreaking deals forged in its bustling meeting rooms and corridors. What began as a small-scale networking opportunity has transformed into a powerhouse of innovation, driving the sector forward with each passing year.

In this article, we delve into the 52 Most Notable JPM Deals in the past 10 years, highlighting the transformative agreements that have emerged from this prestigious conference. Join us as we explore the pivotal transactions that have reshaped the biotech landscape and download our comprehensive report to discover the companies poised to lead the industry into 2025.

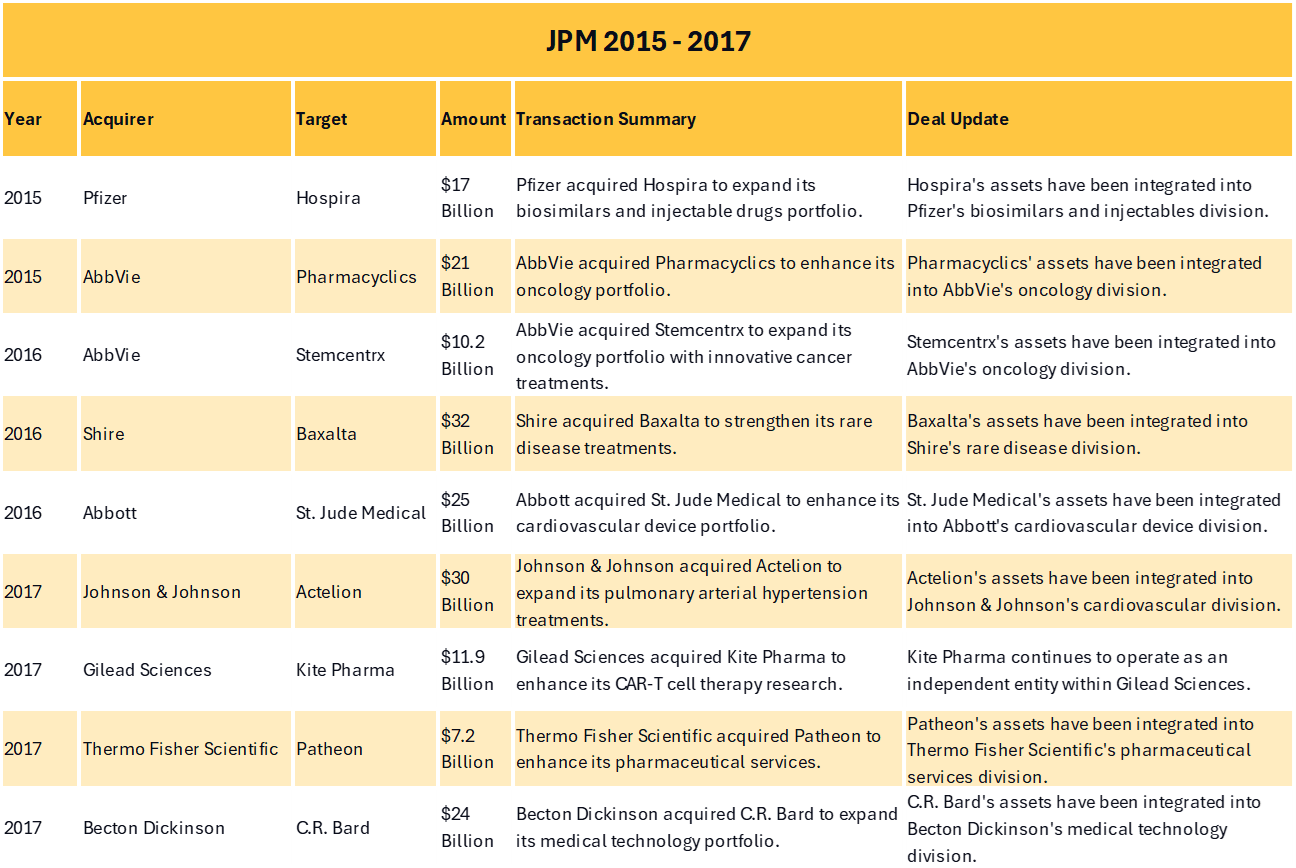

JPM | 2015-2017

2015 and 2017, delivered key transactions that continue to reshape the industry today. Those deals included Pfizer's $17 billion acquisition of Hospira, AbbVie's $21 billion purchase of Pharmacyclics and $10.2 billion buyout of Stemcentrx, and Shire's $32 billion acquisition of Baxalta. Other significant deals were Abbott's $25 billion acquisition of St. Jude Medical, Johnson & Johnson's $30 billion purchase of Actelion, Gilead Sciences' $11.9 billion acquisition of Kite Pharma, Thermo Fisher Scientific's $7.2 billion buyout of Patheon, and Becton Dickinson's $24 billion acquisition of C.R. Bard. These moves underscore the industry's dynamic and innovative attitude toward multidisciplinary development during this period.

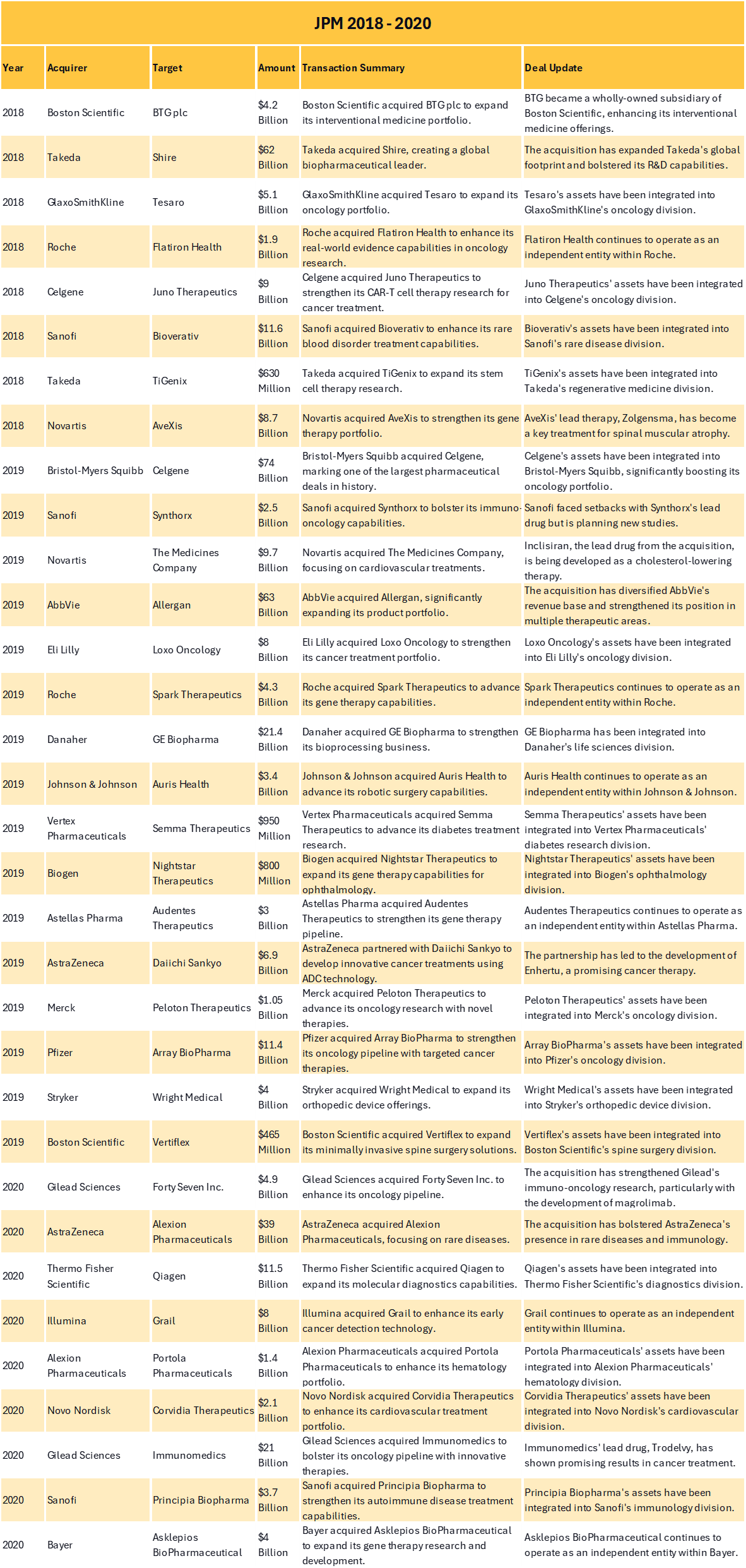

JPM | 2018-2020

Between 2018 and 2020, the JP Morgan Biotech Conference also saw transformative deals in the form of big names on both sides of the transaction. This period is highlighted by the dynamic duo; Takeda's acquisition of Shire and Bristol-Myers Squibb's purchase of Celgene. Significant transactions also involved Boston Scientific, GlaxoSmithKline, and Roche, highlighting advancements in rare disease treatments, immuno-oncology, and cardiovascular therapies.

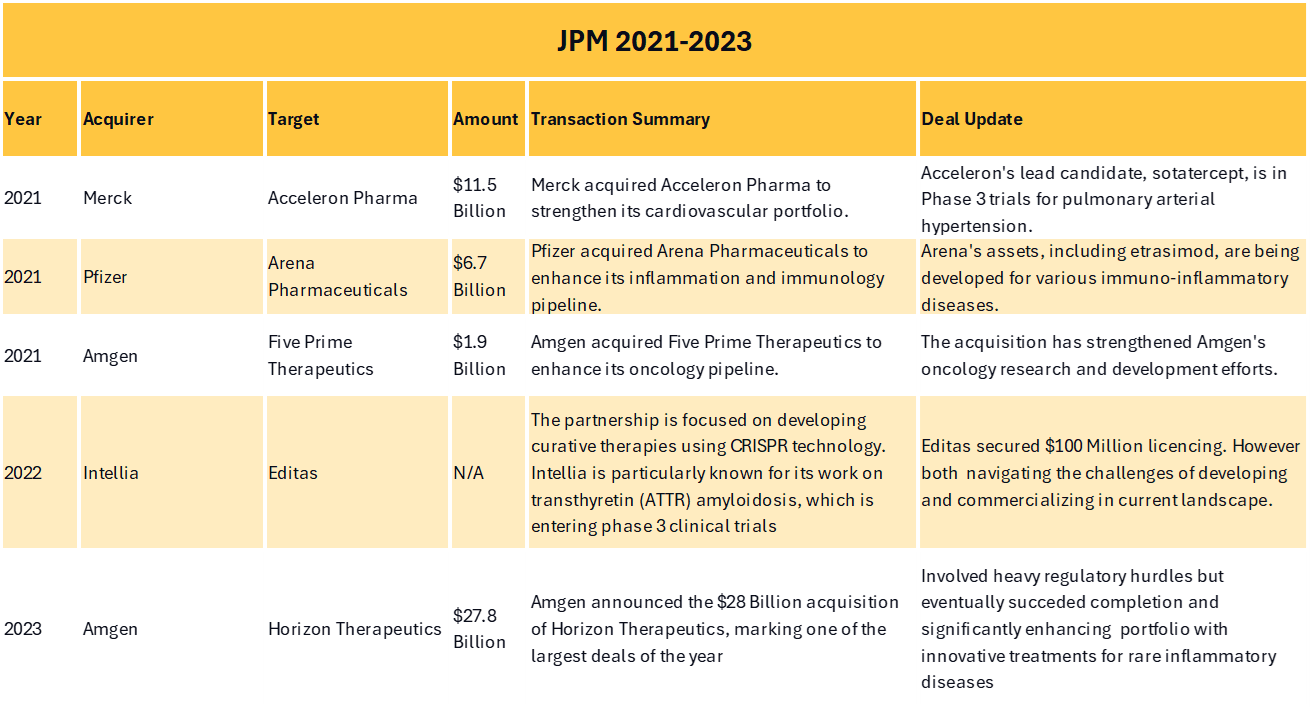

JPM | 2021-2023

2021 signifies the start of post-covid JPM and continues through 2023, where the JP Morgan Conference saw significantly more deals north of $1 billion range. Notable transactions featured; Merck's $11.5 billion acquisition of Acceleron Pharma and Pfizer's $6.7 billion purchase of Arena Pharmaceuticals. Amgen acquired Five Prime Therapeutics for $1.9 billion and later Horizon Therapeutics for $28 billion, enhancing its portfolio with rare disease treatments. Worth noting, Intellia and Editas partnered on CRISPR technology to develop curative therapies. In turn, reinforcing the technologys direction since recent conception.

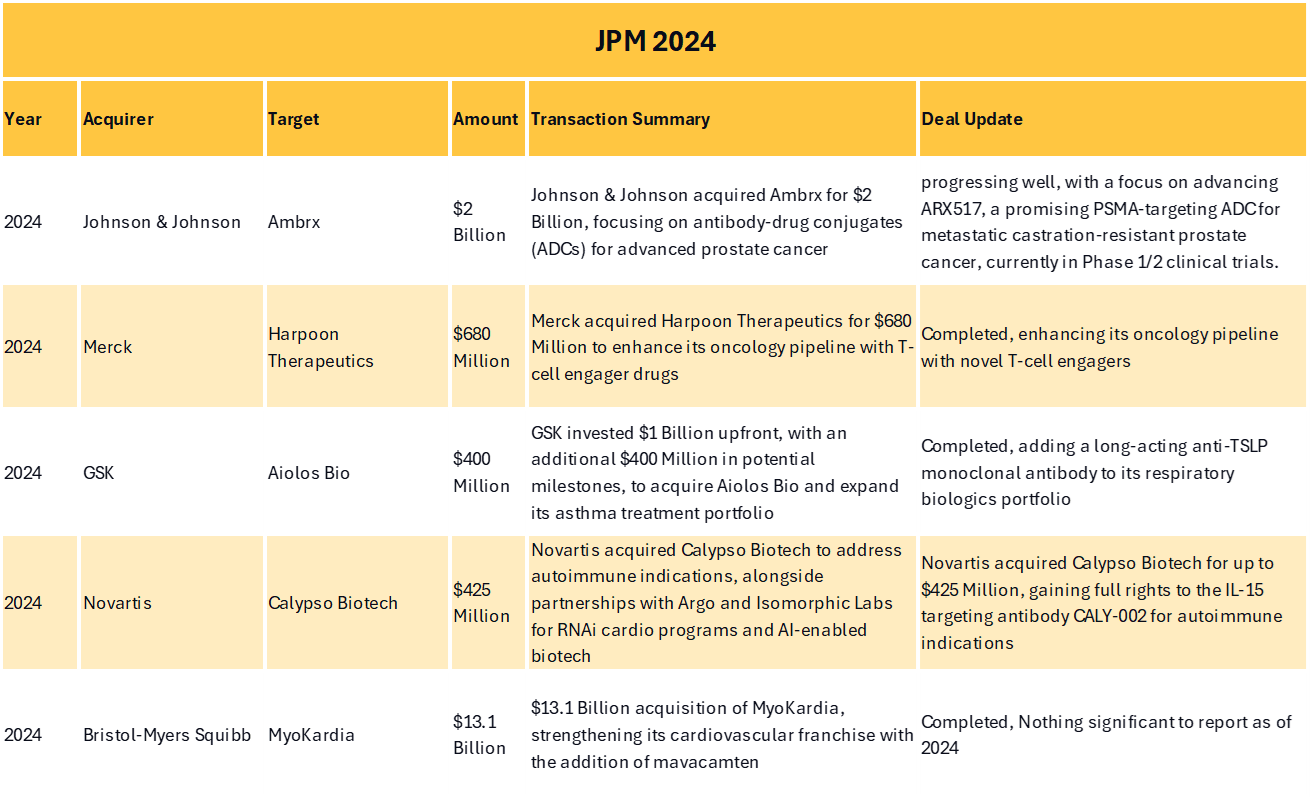

JPM | 2024

In 2024, we saw a mix of everything reach the deal floor. However, it’s better described as an expensive year to purchase pipelines... Johnson & Johnson notably acquired Ambrx for $2 billion, focusing on prostate cancer treatments. Merck enhanced its oncology pipeline by acquiring Harpoon Therapeutics for $680 million. GSK expanded its respiratory biologics portfolio with Aiolos Bio for $1 billion upfront, plus $400 million in potential milestones. Novartis addressed autoimmune indications through its $425 million acquisition of Calypso Biotech, and Bristol-Myers Squibb strengthened its cardiovascular franchise with the $13.1 billion acquisition of MyoKardia. 2024 managed to further highlight the conference's ongoing influence in it’s capacity to deliver a more diverse range of buying and selling.

JPM | 2025

The JPM Healthcare Conference has long been the stage for transformative deals that shape the biotech industry's future. As the 2025 conference approaches, the stakes are higher than ever, with new trends, emerging innovations, and potential acquisitions on the horizon.

Our exclusive prospectus dives deep into these pivotal developments, offering insights to help you navigate the dynamic biotech landscape and capitalize on upcoming opportunities.

Don't miss your chance to get ahead of this year's conference

Download kbDNA's 2025 JPM Conference Prospectus today